A deeper look: COVID-19 impact on Business aviation by country

The Covid-19 outbreak is having a considerable impact on the aviation industry in Europe and around the world. More than 7 months after the beginning of the crisis and the grounding of almost all European airplanes until April, it is still difficult to have an overview of the impact of the pandemic on Business aviation

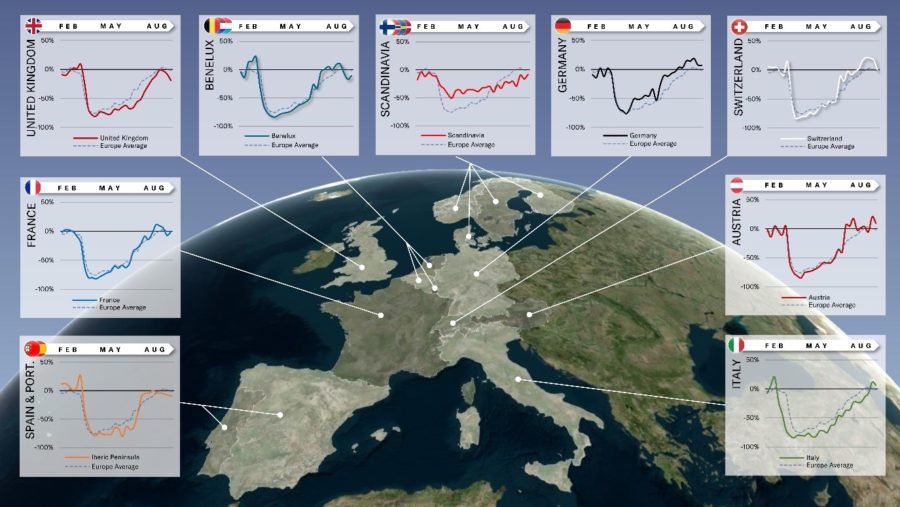

While aviation is global in nature, the measures taken at national levels in response to the spread of the pandemic have had very heterogeneous effects on air transport in the different European countries. The following few graphs and analyses seek to highlight some of the major effects of the Covid-19 crisis on the major European business aviation markets, from the first borders closures around mid-March to the gradual recovery observed at the end of the summer.

France

Europe’s leading business aviation market, the measures taken by the French government at the beginning of the outbreak had almost immediate effects in France (airlines and Business aviation). Business aviation fell down and stabilized at around -80% during the month of April, before seeing a slow but stable recovery until the summer. France’s curve is representative of Europe’s average.

Year to Date Performance: From January to August 2020, France is -33% below 2019 levels.

United Kingdom

The first few weeks of the crisis were marked by an uptick in Business aviation activity, before plummeting to -80% at the beginning of April. The recovery in Business aviation in the United Kingdom is more timid than in the rest of Europe. With Scandinavia, the country remains the only major European Business aviation market with a 20% drop in traffic over the summer period (July and August).

Year to Date Performance: From January to August 2020, United Kingdom is -37% below 2019

Germany

As in France, the measures taken by the German government at the beginning of the crisis immediately led to a drop in business aviation traffic, which stabilized at around -70%. Nevertheless, the recovery in Business aviation has been ahead of Europe’s average curve. Activity levels had “returned to normal” by the first week of July.

Year to Date Performance: From January to August 2020, Germany is -25% below 2019

Switzerland

As observed in some other European countries, business aviation in Switzerland experienced an increase in activity in the first weeks of the crisis (mainly repatriation flights before the generalized containment in Europe). Business aviation recovery was broadly in line with the European average, before accelerating sharply at the beginning of the summer. In Switzerland, July and August 2020 performed better than in 2019 (+6%).

Year to Date Performance: From January to August 2020, Switzerland is -27% below 2019

Italy

The first outbreak of Covid -19 contamination was in Italy, and quite logically the Italian curve was a few weeks ahead of the other countries, dropping to -85% at the bottom of the crisis. Nevertheless, the recovery of business aviation traffic from mid-June was slightly slower than the European average.

Year to Date Performance: From January to August 2020, Italy is -35% below 2019

Spain & Portugal

The first weeks of the crisis were marked by a strong increase in business aviation traffic on the Iberian Peninsula (+20%), before a drop in activity of around -75% that lasted until the second half of June. As southern Europe is a highly seasonal region, the beginning of the summer led to a sharp increase in traffic, which returned to “normal levels” faster than the European average. Though, the summer period was slightly below 2019 figures (-6%)

Year to Date Performance: From January to August 2020, Iberian Peninsula is -33% below 2019

Scandinavia

Scandinavia is a market apart in the European landscape. Firstly, Scandinavian governments took a softer approach toward restrictions (in comparison with other countries), and secondly those countries heavily depend on aviation as an internal means of transportation. One of the main characteristics is the preponderance of domestic flights (between 60% and 80% of air traffic in normal times). As a consequence, the decline has been much less than anywhere else in Europe (-50% at the worst of the crisis). However, the recovery is slow and at the end of August, traffic remains below normal levels (-20% over the whole Scandinavian summer).

Year to Date Performance: From January to August 2020, Scandinavia is -27% below 2019

Benelux

The Belgian, Dutch and Luxembourg markets have suffered the effects of the crisis similar to the European average. There was an upsurge in repatriation flights in the first weeks of the crisis, followed by a sharp drop in traffic (as everywhere throughout Europe) and a floor level at -80% during April. The recovery in traffic was gradual, with an acceleration at the beginning of the summer.

Year to Date Performance: From January to August 2020, Benelux is -31% below 2019

Austria

The Austrian market was impacted similarly to the European average, but in a particularly bumpy way in the first weeks (similarly to the German market). From the end of May, the slow recovery of Business aviation traffic was stable. We observed an acceleration at the beginning of the summer period, which was globally above the 2019 levels (+6% in July-August).

Year to Date Performance: From January to August 2020, Austria is -26% below 2019

The European Business Aviation Association keeps monitoring developments related to the COVID-19 outbreak and its impact on the aviation sector at large. To that extent, further analyses will continue to be produced in the coming months. EBAA makes a number of tools and services available to members and the Business aviation community.