Fit-For-55 Last-mile: What to expect for Business aviation

The "Fit for 55" package is a set of proposals put forward by the European Commission in July 2021 to help member states of the European Union decarbonise the European economy.

The “Fit for 55” package is a set of proposals put forward by the European Commission in July 2021 to help member states of the European Union decarbonise the European economy by reaching a target of 55% greenhouse gas emissions reduction by 2030. The goal of the package is to help the EU achieve its climate goals and transition to a more sustainable, low-carbon economy.

Transport is addressed by Fit-for-55 with 11 legislative proposals also affecting the aviation sector and, by extension, Business aviation.

In particular, three proposals affect Business aviation directly: The Energy Taxation Directive, The ReFuelEU Initiative, and the EU Emissions Trading System (EU-ETS).

In summary, these are the main pillars of the three legislative dossiers:

- The Energy Taxation Directive sets guidelines for the taxation of energy products and electricity within the EU. The taxation intends to rank fuels and electricity according to energy content and environmental performance and for member states to tax them accordingly, helping to ensure that the most polluting energy products bear the most significant amount of tax.

- The ReFuelEU Initiative is a proposed initiative to increase the use of Sustainable Aviation Fuel (SAF) in order to reduce CO2 emissions from aviation. This Initiative is an essential policy tool designed to increase the uptake of Sustainable Aviation Fuels (SAFs).

- The EU ETS for aviation is a cap-and-trade system that aims to reduce CO2 emissions from aviation by setting limits on emissions and allowing airlines and general aviation operators to buy and sell emissions allowances.

EBAA’s Position

EBAA has remained in close contact with policymakers across the three European Institutions (the European Commission, the European Parliament and the European Commission), providing its inputs to make sure that Business aviation interests would have been taken into consideration in the legislative process.

Its positions have revolved around the crucial theme of how to combine the objective of aviation’s decarbonisation with the specific needs of the European Business aviation sector, made up of a majority of SMEs which might face difficulties in adapting swiftly to the ambitious targets set up by the European institutions.

As far as the ETS is concerned, EBAA stands for an alignment between the EU-ETS and CORSIA, the global measure developed by the International Civil Aviation Organization (ICAO), to ensure the European Business aviation sector would not be forced to participate in both schemes simultaneously. This is to avoid issues such as double counting and increased administrative burden on small operators.

Moreover, EBAA suggests the revenues of the EU-ETS should be earmarked and allocated to aviation projects that contribute to environmental improvement or are environmentally responsible, following the principle whereby increased taxation should go hand in hand with concrete financial support to spur sustainable innovation within the aviation sector.

EBAA’s message with regards to ReFuelEU stresses the need for a legislative proposal aiming to increase SAF uptake in Europe to be realistic and based on an incremental approach. This would give the European SAF value chain the time and resources to develop the required infrastructures and levels of production that are necessary to meet the objectives of the proposal.

Another issue concerns the current definition of the proposal which would lead to the exclusion of around half of Business aviation operations from the benefit of using SAF. Indeed, the definitions of ‘Union airports’ and ‘aircraft operators’ will have a negative impact on the sector’s access to SAF since ‘small’ operators, often operating only one or two aircraft only, do not reach the threshold of 729 departures from Union airports and the definition of Union airports itself would also exclude a significant part of operations as Business aviation relies significantly on secondary or tertiary airports that do not fall within the definition of Union airports.

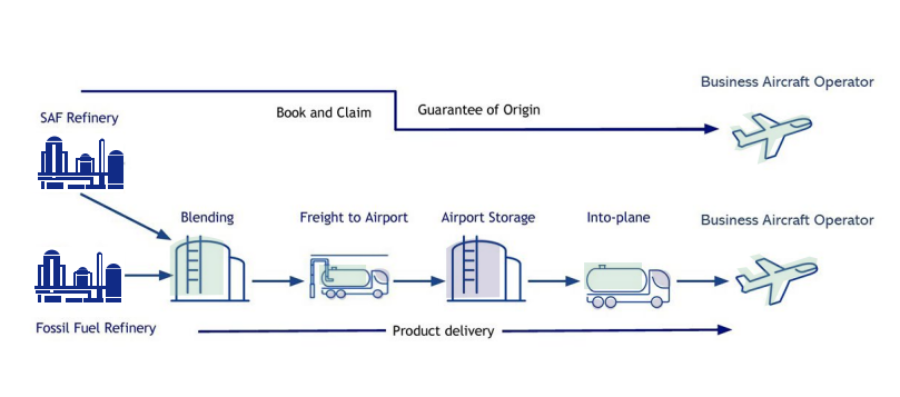

Given the limited development of SAF infrastructure, the connectivity of smaller airports and the geographical spread of SAF across Europe, EBAA’s proposed solution to overcome these constraints is the establishment of a Book & Claim system.

A Book & Claim system for SAF means one can purchase (“book”) a volume of SAF anywhere on the planet, which will be used even without having direct access to it, and “claim” the acknowledgement of its use toward sustainability programs, market-based measures, or legislative .

A Book & Claim system can:

- Allow operators to purchase SAF even if it is not available in their re-fuel location;

- Provide customers with a means of supporting decarbonisation of aviation;

- Help bring finance into the SAF system that might not have been there otherwise;

- Support the virtuous cycle of increasing the availability and demand of SAF.

On the Energy Taxation Directive (ETD), it is worth highlighting that the revised ETD sets the scene for a new tax regime applicable to all commercial air transport flights, except ‘ business flights and pleasure flights’, including an annual tax increase.

The Business aviation sector consists of various business models, and the boundary from one type of flight to another can be challenging to draw. This could, in part, lead to inconsistent taxation within the Business aviation sector affecting competition therein. Therefore, to ensure a smooth implementation of the Directive at the national level, EBAA calls for clarity on the definitions so all Member States will consistently interpret the legislation.

In addition, the general tax regime should include Business aviation flights operated for commercial purposes (e.g. flights operated under a CAT licence) and all flights being operated for remuneration. For all medical and humanitarian flights, EBAA calls for granting an exemption to the ETD. Lastly, EBAA suggests the revenues of environmentally-based taxation should be earmarked and allocated to aviation projects that contribute to environmental improvement or are environmentally responsible.

Where we are now in the legislative process

While the Energy Taxation Directive is still at an early stage of its legislative process, as the Responsible Committees in the European Parliament have yet to agree on their initial opinion drafts, the EU ETS for aviation was adopted by the Parliament’s plenary and a provisional deal was struck between the Parliament and the Member States in early December 2022.

According to the agreement, the EU ETS will apply for intra-European flights (including departing flights to the United Kingdom and Switzerland), while CORSIA will apply to extra-European flights to and from third countries participating in CORSIA (‘clean cut’) from 2022 to 2027. EU legislators also agreed to gradually phase out free emission allowances for the aviation sector as follows: 25% in 2024, 50% in 2025 and 100% from 2026. This means allowances will be fully auctioned from 2026. As regards the use of revenues, co-legislators agreed to transfer 5 million in allowances from the aviation sector to the Innovation Fund, the EU’s fund dedicated to investing in clean energy project across Europe.

Concerning Business aviation, private flights carried out by commercial operators will remain priced under the EU ETS. However, private flights – operated by non-commercial operators emitting less than 1 000 tonnes of carbon dioxide per year or by commercial operators operating fewer than 243 flights in a continuous period of four months or emitting less than 10 000 tonnes of carbon dioxide per year – are excluded from the EU ETS on the grounds that it would otherwise impose a disproportionate administrative burden.

On ReFuelEU, in July 2022, the European Parliament’s Plenary voted in favour of including the amendment to ReFuelEU that contemplates the introduction of a book and claim system for SAF across the Union. The amendment followed a dedicated campaign by aviation stakeholders together with EBAA, which worked to bridge the knowledge gap on SAF to all stakeholders across the Business aviation value chain as well as policymakers.

At the present time, the legislative file is being discussed between the Parliament and the Member States, with the supervision of the Commission, in the so called “trilogue” meetings or “Interistitutional Negotiations”. The negotiations will likely be complicated as several Member States claim that they already have national plans to decarbonise aviation aiming at CO2 emissions reduction targets different from the 55% target set up by the whole European Union’s bloc of countries. Another sensible issue regards the possibility of using nuclear power to generate e-fuels, advocated by the Europe People’s Party but strongly opposed by the Socialists and Greens.

Moreover, at the Council level, some Member States maintain the necessary global scope of the Book & Claim system would cause issues related to double counting, different standards for the certification of SAF, and, within Europe, difficulties with the assessment of the claim portion of the system.

EBAA will continue monitoring the next steps of the legislative process and leverage its network of policy contacts in Brussels to ensure that the perspective of Business aviation will be duly reflected in these crucial policy dossiers.