The EBAA and GAMA SAF Recommendations: Business aviation leading by example to decarbonise aviation

The SAF Recommendations laid out by EBAA and GAMA aim to address obstacles currently halting Business aviation's efforts to adopt more Sustainable Aviation Fuel...

Following the adoption of European Union regulations mandating a gradual increase of Sustainable Aviation Fuel (SAF) supply and usage at Union airports, EBAA and GAMA acknowledged that such a legislative framework lacked adequate measures to allow the Business aviation sector to decarbonise in alignment with a rising demand from its users to fly sustainably.

In response to this challenge, EBAA and GAMA, representing the entire European Business and general aviation value chain, developed an SAF strategy consisting of recommendations aimed at Business aviation operators and airports to support the industry in the widespread adoption of SAF across Europe.

Legislative and market barriers to SAF adoption by Business aviation

At present, the landscape of SAF presents a multitude of challenges to the Business aviation sector. Currently, SAF availability is confined to a select number of airports in Europe and globally, while production of SAF remains low. Adding to the complexity, operators often pay attention to the perceived higher cost of fuelling 100% neat SAF, overlooking the cost advantages associated with blended options. In the regulatory sphere, the EU’s ReFuelEU Regulation steps into the arena, mandating a gradual increase in SAF supply to Union airports from 2025 to 2050. However, this legislation causes a critical gap by not including both the supply to smaller regional airports and a European Book & Claim system within its scope. These exclusions prove to be pivotal in addressing the restricted access of Business aviation to SAF.

As a result, Business aircraft operators are facing challenges in incorporating SAF into their operations. These obstacles are particularly prevalent among those operators who prioritise their corporate policy and ESG / CSR criteria and/or those who seek to fulfil clients’ demand to fly with SAF. In shaping the SAF strategy, EBAA and GAMA aimed to help increase the uptake of SAF by operators and availability throughout dedicated airports by providing these two actors with tailored recommendations.

Recommendations for Business aircraft operators

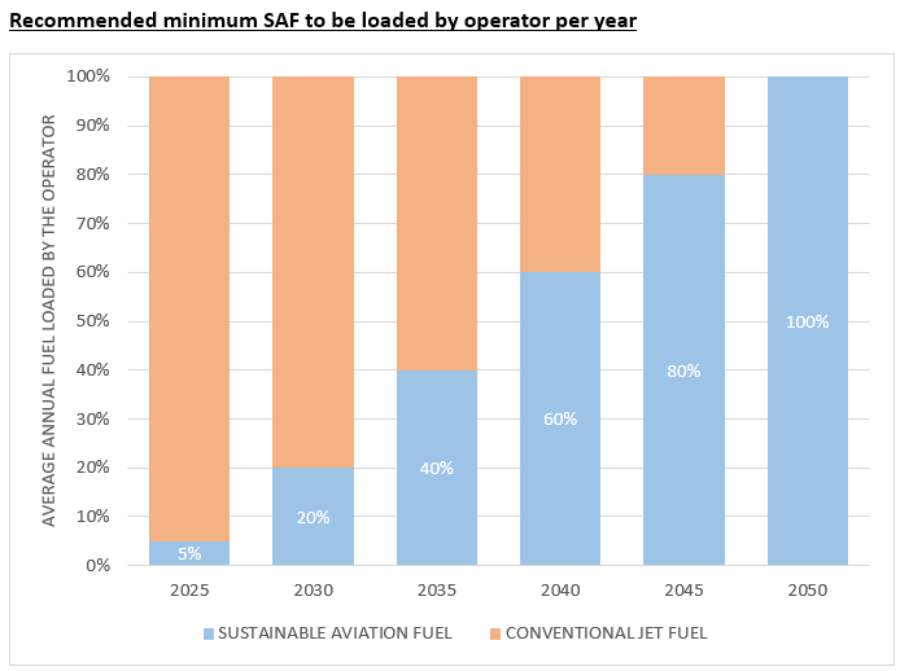

At the business aircraft operator level, EBAA and GAMA recommend a progressive ramp-up of the incorporation of SAF on-board business aircraft. On a yearly average basis, business aircraft operators shall aim to meet a growing minimum SAF ratio between 2025 and 2050, regardless of any blending, and, should SAF not be physically available at certain airports, operators are recommended to utilise a robust and reliable Book & Claim system that allows for clear accounting and accountability to meet the SAF ratio in the graph below. These recommendations apply to all types of flights, whether domestic or international, private or commercial. They should be implemented independently of any other mechanism such as CORSIA or ETS for which SAF benefits should be claimed individually by the operator.

Recommendations for Business aviation airports

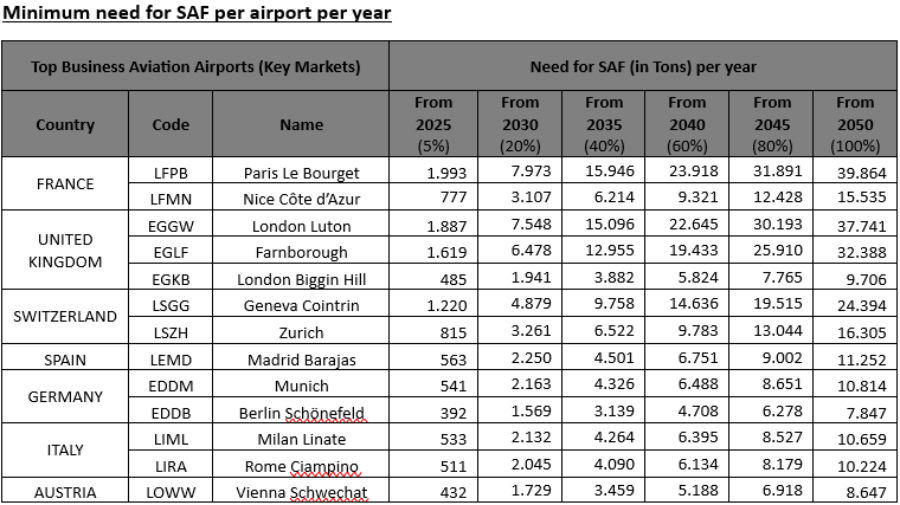

At the airport level and prior to Q1 of 2025, EBAA and GAMA confirm that they will actively work with the European business aviation airports listed in the table below to facilitate the provision of SAF during normal operations to business aviation aircraft, aligning with the SAF volumes per year as set out above. Furthermore, EBAA and GAMA will actively work with all other European airports to facilitate a Book & Claim system for business aircraft operators to be used in cases where SAF is not physically available.

Setting Business aviation in the driving seat of aviation decarbonisation

Our sector has been mindful of the need to decarbonise its operations well before climate change became a global priority. Already in 2009, the industry introduced the Business Aviation Commitment on Climate Change (BACCC), outlining its climate-action efforts through a combination of measures: new technology, SAF, operational improvements and modernised infrastructure, and market-based measures such as offsetting. The BACCC was updated in 2021 to the ambitious goal of net-zero carbon emissions by 2050, and the BACCC was also reinforced in 2022 by the International Civil Aviation Organization (ICAO) as voted for by its 193 Member States at its triennial General Assembly.

Now, in the face of regulatory pressure and disadvantageous market conditions, these recommendations seek to create adequate conditions for our sector to access SAF and demonstrate to external stakeholders that Business aviation is at the forefront of the transition towards achieving net-zero carbon emissions by 2050.